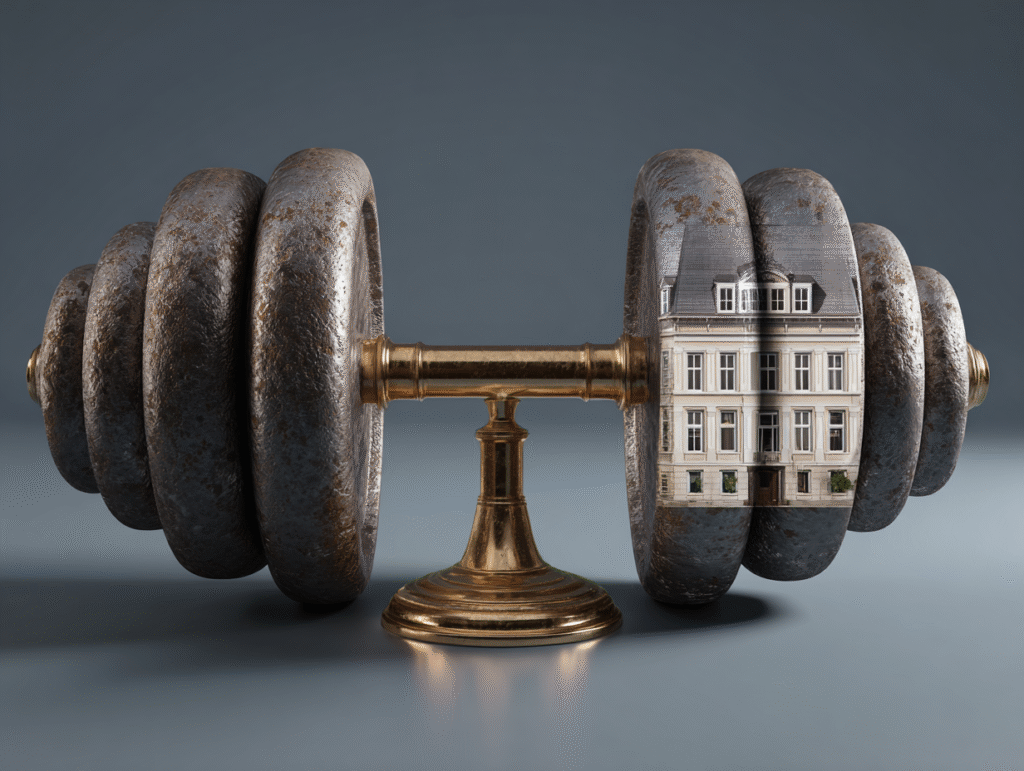

As investors prepare for 2026, one allocation framework is emerging across family offices, institutional capital, and sophisticated accredited investors: the Allocation Barbell Strategy. It is simple in theory, powerful in practice, and uniquely suited to the economic backdrop unfolding as the cycle turns.

Instead of spreading capital evenly across a wide mix of moderate-risk assets, investors are increasingly concentrating at the two ends of the risk and return spectrum:

(1) ultra-stable, inflation-resistant assets and

(2) high-conviction, high-upside opportunities.

The middle, often public equities, moderate-yield debt, and nondifferentiated real estate, is where investors are allocating less.

This barbell approach is widely attributed to Nassim Nicholas Taleb, but the 2026 market environment makes it particularly effective. Inflation remains above historical averages, interest rates behave unpredictably, and supply constraints in real estate continue to tighten. A barbell allocation gives investors both protection and upside while avoiding the volatility of the middle.

Why the Barbell Strategy Fits 2026 Conditions

1. Inflation Is Sticky, Even if Moderating

Although inflation has cooled from its 2022 peak, it remains above the Federal Reserve’s 2 percent target. (Bureau of Labor Statistics, CPI Summary) Economists at Goldman Sachs and J. P. Morgan note that structural inflation related to wage pressure, supply chains, and housing shortages is likely to continue into 2026. Inflation reduces the real value of public market returns. This makes hard assets and cash-flowing real estate attractive anchors for the stability side of the barbell.

2. Public Markets Are Highly Correlated and Volatile

An overlooked trend heading into 2026 is the rising correlation across public asset classes. Equities, bonds, and in some cases commodities are reacting to the same macroeconomic signals. (Federal Reserve Bank of St. Louis Correlation Data) When correlation rises, diversification inside the public markets breaks down. As a result, sophisticated investors are looking to private alternatives such as land-backed real estate, Build-to-Rent developments, and income-producing assets. These sit firmly on the stability side of the barbell.

3. The U.S. Housing Deficit Supports Real Estate Value

According to the National Association of Realtors, the United States remains 3.8 million housing units short. Colorado is among the most undersupplied states. High demand and restricted supply continue to push rents and asset values upward. This strengthens the case for real estate as the low-volatility anchor of a barbell strategy.

How Investors Structure the Two Sides of the 2026 Barbell

Side 1: Ultra-Stable, Inflation-Resistant Assets

These assets protect principal and hedge inflation:

- Build-to-Rent communities. National occupancy ranges from 96 to 98 percent.

(Yardi Matrix Build to Rent Report) - Entitled land with completed utilities or municipal approvals

- Private credit backed by real assets

- Mixed-use or hospitality assets with diversified revenue

- Income-producing operating assets such as vineyards or event estates

These assets provide predictability, lower correlation, and steady yield.

Side 2: High-Conviction, High-Upisde Opportunities

Return amplification happens on this side:

- Development projects with strong IRR projections

- Distressed credit or recapitalization opportunities

- High-growth mixed-use developments in constrained markets

- Opportunistic private funds

- Vertically integrated real estate strategies

The key is underwriting quality, sponsor execution, and location. Successful investors are not speculating. They are selecting high-conviction opportunities with controlled risk.

Why Investors Are Avoiding the Middle

The middle, which includes moderate-risk public equities, bond proxies, REITs, and nonstrategic real estate, offers neither meaningful downside protection nor compelling upside. These assets move with interest rate headlines, do not hedge inflation, and do not outperform during rebounds. This is why LPs are redistributing capital away from the center and into the two ends of the barbell where they have more control and better visibility.

Why the Barbell Strategy Matters for Colorado Real Estate

Colorado offers both sides of the barbell in a single market.

On the stability side:

- Housing supply constraints remain severe

- Population growth continues along the I-25 corridor

- Entitled land is increasingly scarce

- Demand for Build-to-Rent communities remains elevated

- Inflation supports rents and replacement-cost value

On the upside side:

- Multi-phase development projects offer strong IRR potential

- In some cases, off-site infrastructure is funded by other developers

- Mixed-use and hospitality assets add diversified revenue

- Institutional capital continues to expand into Colorado growth markets

This combination makes Colorado one of the few regions in the country where a barbell allocation is naturally supported by both macro trends and local fundamentals.

Conclusion

The 2026 Allocation Barbell Strategy is more than a trend. It is a disciplined response to an economic landscape shaped by inflation, volatility, and constrained supply. By concentrating capital in stable hard assets on one end and high-conviction upside on the other, investors can protect capital and pursue growth while avoiding the stagnant center.

As 2026 approaches, sophisticated investors are not asking how to build a balanced portfolio.

They are asking how to build a barbell.